Amount Due From Director Asset

7 as the practice of classifying amount due from subsidiaries as current asset based on repayable on demand feature is prevalent frsic was asked to provide guidance for consistent application of the matter.

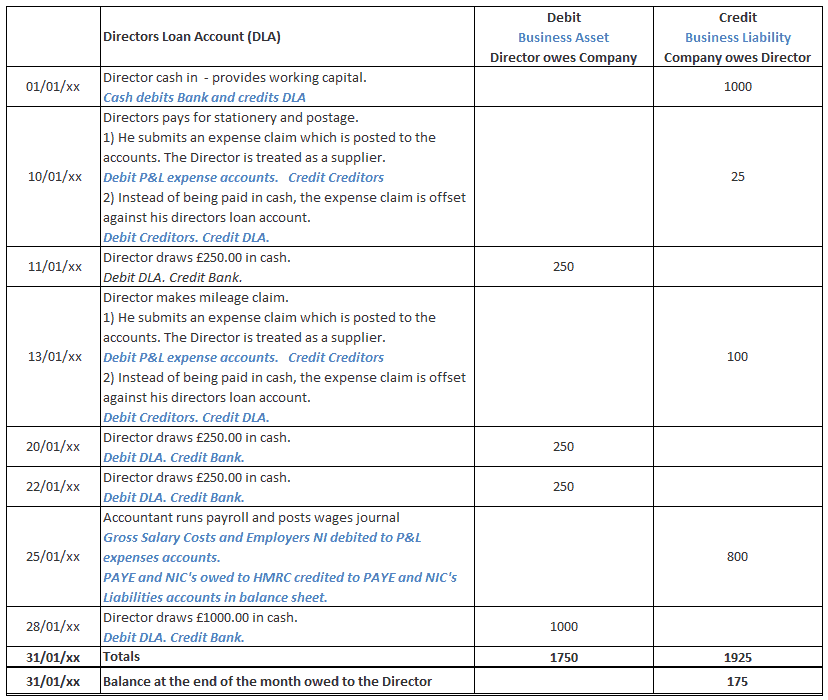

Amount due from director asset. That is an amount owing by a director to the company. Amount due could be for loans made from the director to the company or due to the director for services rendered. Director who certifies that.

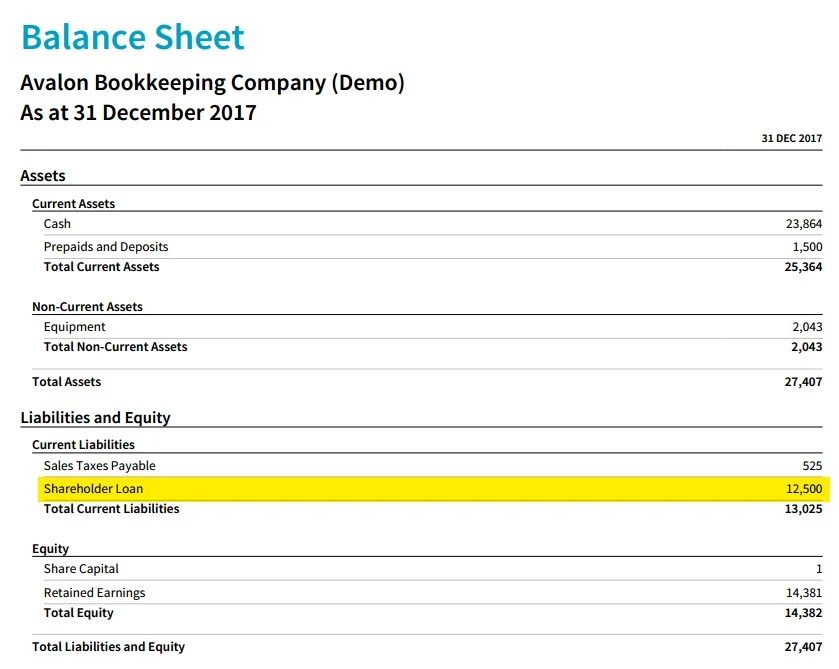

The salvage value of an asset is based on what a company expects to receive in exchange for selling or. Often a company s financial accounts will show directors loans. Amount due from director could be for a loan made by the company to the director so the director owes the company or perhaps for goods or services provided to the director from the company for which the director owes the company.

So it is an asset of the company that is recoverable by a company or the company s liquidator. Select the new icon expense enter create the director in the payee field in the payment account select the bank account the amount is being paid from in the date field select the date the amount was debited from your account in the category column enter the asset account. A the above statement has to the best of his knowledge and belief.

The write off process involves the following steps. Amount due from directo rs and connected persons a secured b. When a director takes more money out of the company than they put back in the loan account becomes overdrawn.

Statement of assets and liabilities form 1 name of the holder of a capital markets services licence. When the value of an asset has declined some portion of its carrying amount should be written off in the accounting records a write off is needed whenever the fair value of an asset is below its carrying amount. As the director s loan account becomes overdrawn it is essentially classed as a company asset due to the liability accrued.

In relation to taxes the money owed to the government when required tax amount totals a greater number than total tax payments previously made. When you then forward the amount to the director we presume from your business bank account create an expense. The total sum of money due for the purchase of a good or service that must be paid by the set due date.

Consensus and basis of consensus.

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)