Amount Due From Director Current Asset

Determine the amount of the write off.

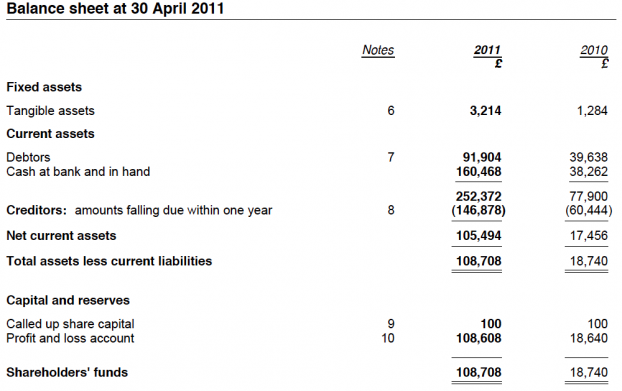

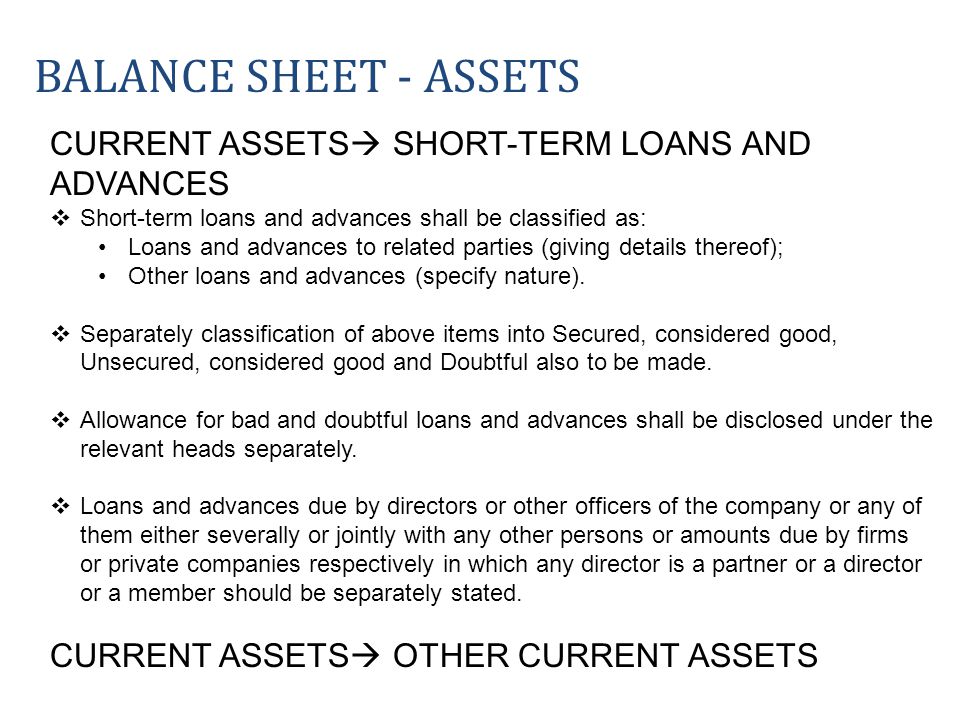

Amount due from director current asset. 97 000 73 000 2 85 000. In the current assets section due to shareholder amounts may artificially inflate current assets if you plan to convert them to bonuses dividends or management fees at year end at which time they become expenses of the business. If a company has a loan payable that requires it to make monthly payments for several years only the principal due in the next twelve months should be reported on the balance sheet as a current liability.

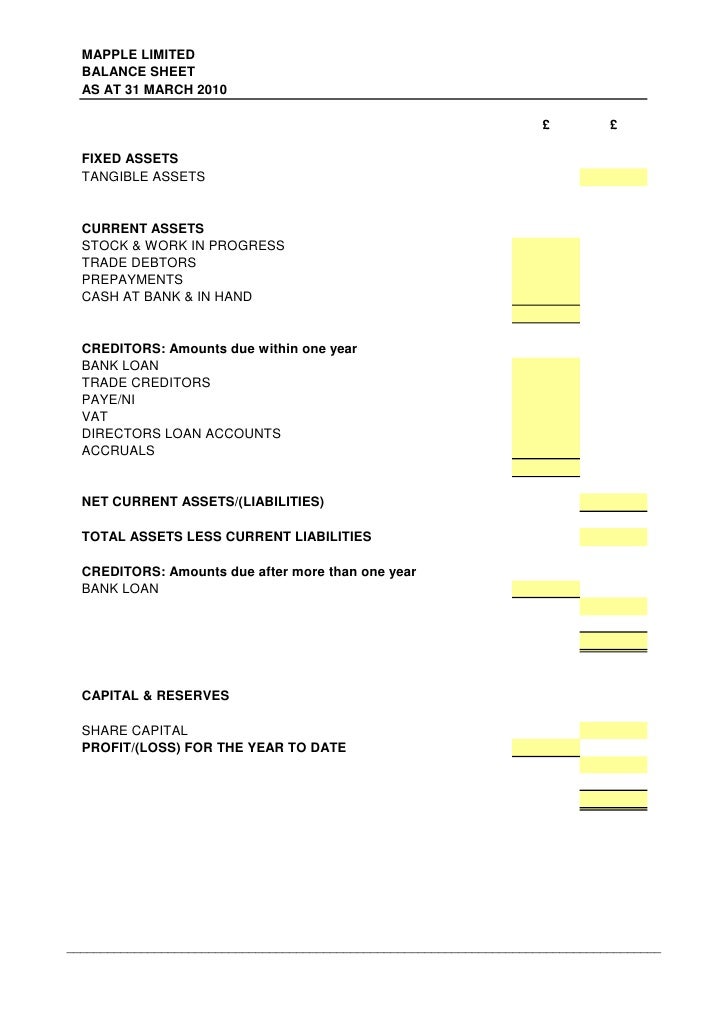

If you would like to account for a loan from the company to a director you will need to set up an asset account. The remaining principal amount should be reported as a long term liability. The second subcategory lists the long term assets.

Current assets include items such as accounts receivable and inventory while noncurrent assets are land and goodwill. Noncurrent liabilities are financial obligations that are not due within a. When the value of an asset has declined some portion of its carrying amount should be written off in the accounting records a write off is needed whenever the fair value of an asset is below its carrying amount.

10 other current assets a deposits b pre payments c others total current assets non current assets 1 fixed assets net of accumulated depreciation 2 securities held as long term investments a at cost b at fair value 3 investments in subsidiarie s and associated. Directors loan joe bloggs loan save and close. Select accounting chart of accounts new account type will be current assets in the detail type select loan to others enter a name e g.

The write off process involves the following steps. Thus the assets are typically listed with a total accumulated depreciation amount subtracted from them. Average current assets total current assets for previous period total current assets for current period 2.

Assets the company expects to sell or dispose of within a year for example stock or money owed from customers. For the cake shop these would be flour fruit cakes cash in the till and money in the bank unless it was a long term savings account not readily accessible.

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)