Amount Due From Director Double Entry

Journal entry for director s remuneration the word remuneration means any money or its equivalent paid to someone in exchange for using their services.

Amount due from director double entry. They can be obtained from banks nbfcs private lenders etc. Supplier expenses credit. Gross amount due from customer represents the amount of revenue earned on a contract but yet billed to the customer if any billed amount is outstanding it is included in trade receivables as explained above it also includes the amount of contract costs incurred to date that have not yet been charged to the income statement.

Select new bank deposit in the account field in the top left ensure you have selected the bank that the amount was received to and the corresponding date in the date field in the received from column within the add funds to this deposit section enter the name of the director in the account column. A loan received becomes due to be paid as per the repayment schedule it may be paid in instalments or all at once. Journal entry for loan payment principal interest loans are a common means of seeking additional capital by the companies.

It therefore represents the contract work in progress inventory. Cash has been used to make the annual repayment to the lender on the due date in accordance with the loan agreement. It is also quite common for directors to be paid a basic directors salary which is also offset against a directors loan account further increasing the amount owed to the director.

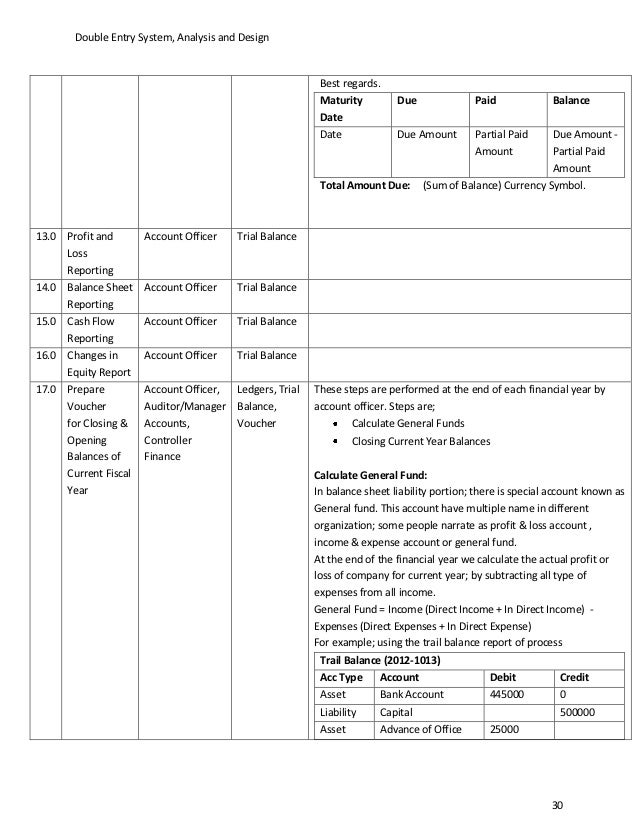

Director has made payment settlement to supplier using his own personal bank account. If we run a payroll for you of say 1250 00 gross equating to 1000 00 net which you should pay yourself the 1000 00 salary due creates a credit in the director loan account dla until such time that your company pays yourself the salary to show that the company still owes you as the director 1000. The director may not be paid his expenses or the actual net salary amount as they fall due but may again offset them against his directors loan.

Amount due from director could be for a loan made by the company to the director so the director owes the company or perhaps for goods or services provided to the director from the company for which the director owes the company. Imagine if an entity purchased a machine during a year but the accounting records do not show whether the machine was purchased for cash or on credit. Any such payment made to directors of a company is to be recorded in the books of accounts with the help of a journal entry for director s remuneration.

When the director pays you the amount back or a proportion create a bank deposit. Accounting entry should be. Amount due could be for loans made from the director to the company or due to the director for services rendered.