Amount Due From Director Iras

A backdoor roth ira allows taxpayers to contribute to a roth ira even if their income is higher than the irs approved amount for such contributions.

Amount due from director iras. Start with your modified agi. Amount of your reduced roth ira contribution. Subtract from the amount in 1.

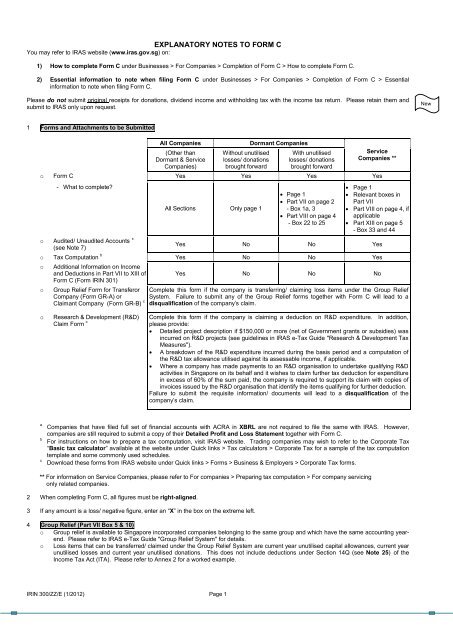

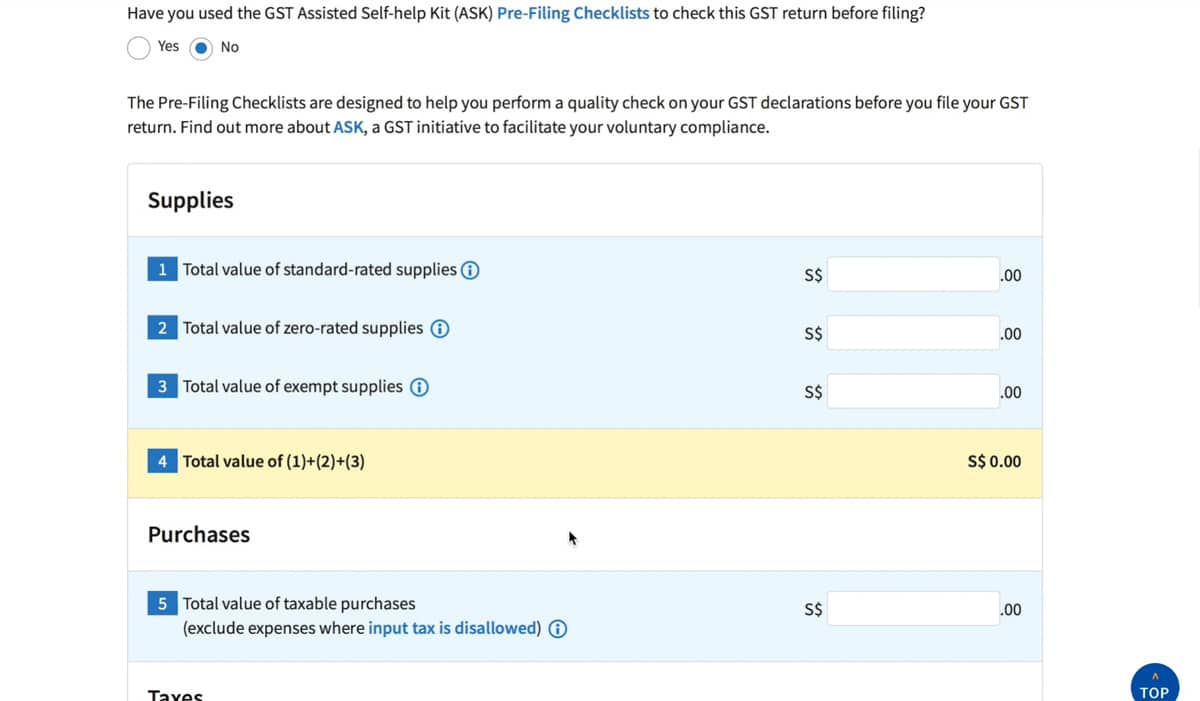

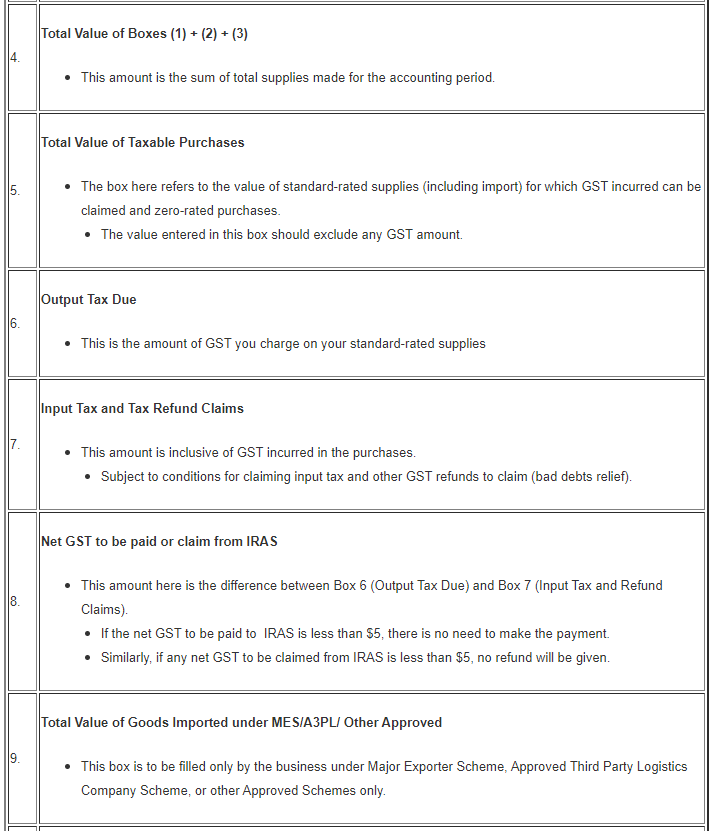

From the various employers and enter the total amount in the respective boxes. System will compute the amount of stamp duty and penalty if any payable. You will be able to print the stamp.

196 000 if filing a joint return or qualifying widow er. Exclude the amount refunded to be refunded by cpf board. All you need is a registered account with us.

A consolidated summary of the transaction will be displayed. This amount is derived from employer s contribution under section b of ir8s less the amount of refund from employer contribution under section c of ir8s. But this year the deadline has been moved to july 15 in response to the coronavirus covid 19 pandemic the irs issued notice 2020 23 extending the 2019 form s june 1 2020 deadline to july 15 2020.

Please enter amend the amount of salary bonus director s fees and other types of employment income as per your form ir8a for the year ending 31 december 2016 in the relevant fields. Businesses to use corppass to transact with iras from 1 sep 2018 corppass is a corporate digital identity for businesses. Registered account if you perform e stamping frequently you may wish to sign up as a corppass user and enjoy additional features.

Click to submit your stamping details and make payment by enets. Director s fees director s fees paid or payable to directors should be included in your submission of salary files to. This is because they have yet to perform requisite services for the accounting year ending 31.

If the loan were taken for less than one calendar year the interest benefits would be computed according to the number of months in that year for which the loans remain outstanding. For simplicity iras may accept computation based on the amount of loan outstanding as at 31 december of each year multiplied by the average prime lending rate for that year. If the amount you can contribute must be reduced figure your reduced contribution limit as follows.

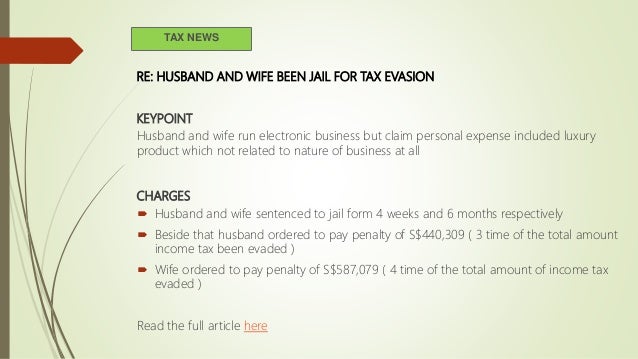

From 1 sep 2018 corppass will be the only login method for online corporate transactions with the government. The amount of director s fees voted and approved on 9 jan 2011 was therefore approved in advance and the directors were not entitled to the director s fees on 9 jan 2011.

.jpg)