Amount Due From Director Lhdn

Prior to 1 7 2008 the amount of exemption was.

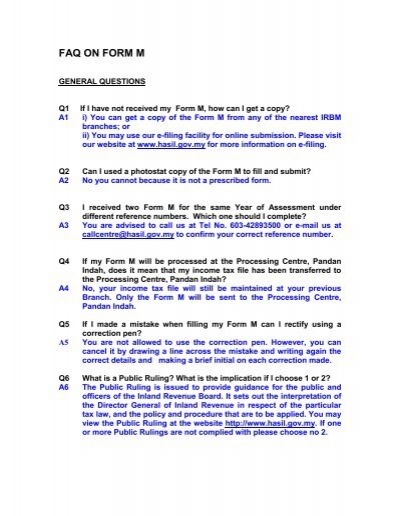

Amount due from director lhdn. Saya boleh letak sebagai drawing dalam balance sheet. I m not sure what the question is. Dla is an account on the company financial records that reports all transactions between the director and the company.

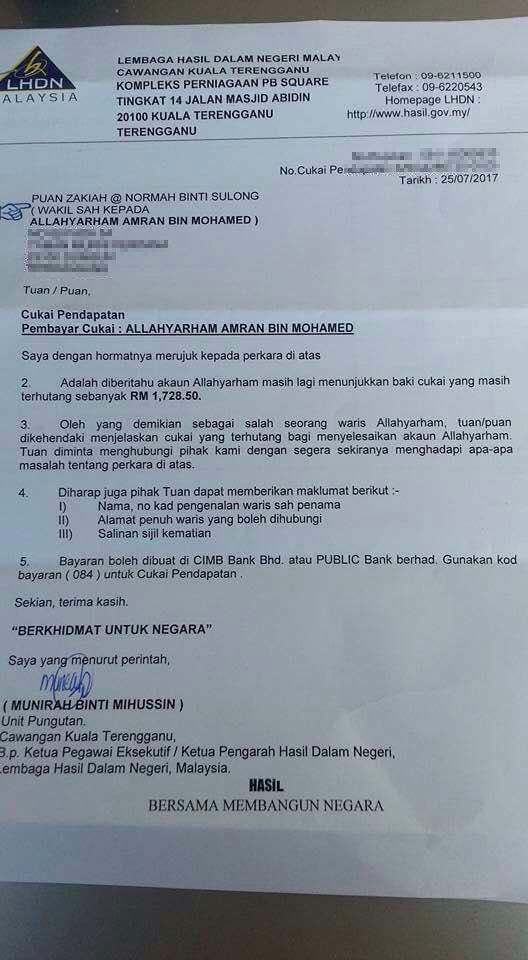

The judge also found the certificate exhibited by the government as proof of the amount of tax due and payable was not signed by the ldhn director general as required under section 142 of the. Amount due from director is what is due from the director. Zakat and fitrah can be claimed as a tax rebate for the actual amount expended up until the total tax amount.

2013 tax filing badges of trade book budget 2013 budget 2014 business company cp 204a cp 204b cp58 deadline deferred annuity director goods and services tax gst income tax inland revenue board interest free loan irb limited liability partnership llp malaysia malaysian taxation members only nst red personal relief private retirement scheme property property investment property taxation prs real. Dia mengatakan tiada malasah sekiranya saya declare ambilan didalam akaun syarikat saya. If the company charges interest of 9 on the director advance the total interest payable by the director is rm7 350 00 which is more than the deemed interest of rm4 083 33.

This would bring your chargeable income down to rm35 000 and the amount of tax you have to pay is rm600. If you own the director 10 and he owes 5 the director got 5 bucks left right. For example say your employment income is rm50 000 a year and you have claimed rm15 000 in tax reliefs.

Amount due to director is what is due the director. Mixed funds if loans or advances to director are from internal funds and external funds the interest income is computed only on the portion related to amount of internal funds. Amounts due to the director from the company should be recorded in the company s books as a creditor while the amounts due from the director to the company should be recorded as a debtor.

Loan or advances to director by a company public ruling no. I rm6 000 for the years of assessment 2003 to 2008 ii. Tetapi ada auditor yang saya rujuk mengatakan ini dikira sebagai amount due to director.

Termination of employment of a service and non service director of a controlled company 13 11. 8 2015 date of publication. In such circumstances the company must.

30 november 2015 page 5 of 16 4 2 3. In this scenario the interest income to be disclosed as earned in the tax return is rm7 350 00. Login to reply the answers post.