Amount Due To Director

In relation to taxes the money owed to the government when required tax amount totals a greater number than total tax payments previously made.

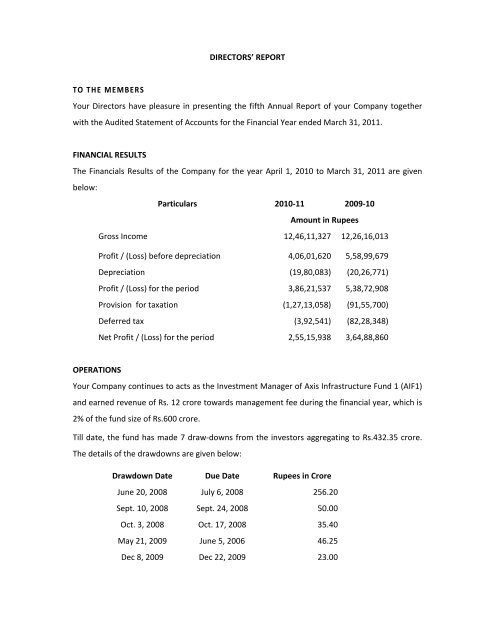

Amount due to director. In dec 2009 apart from receiving director s fee of 5 000 she was provided with an interest free loan of 300 000 by the company. This is because they have yet to perform requisite services for the accounting year ending 31 dec 2020. 8 2015 date of publication.

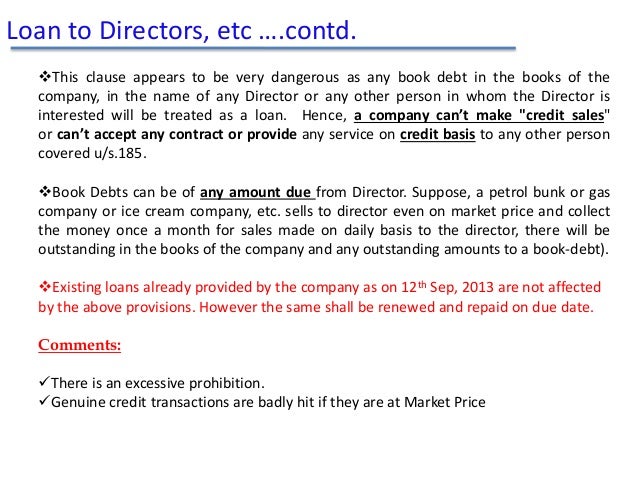

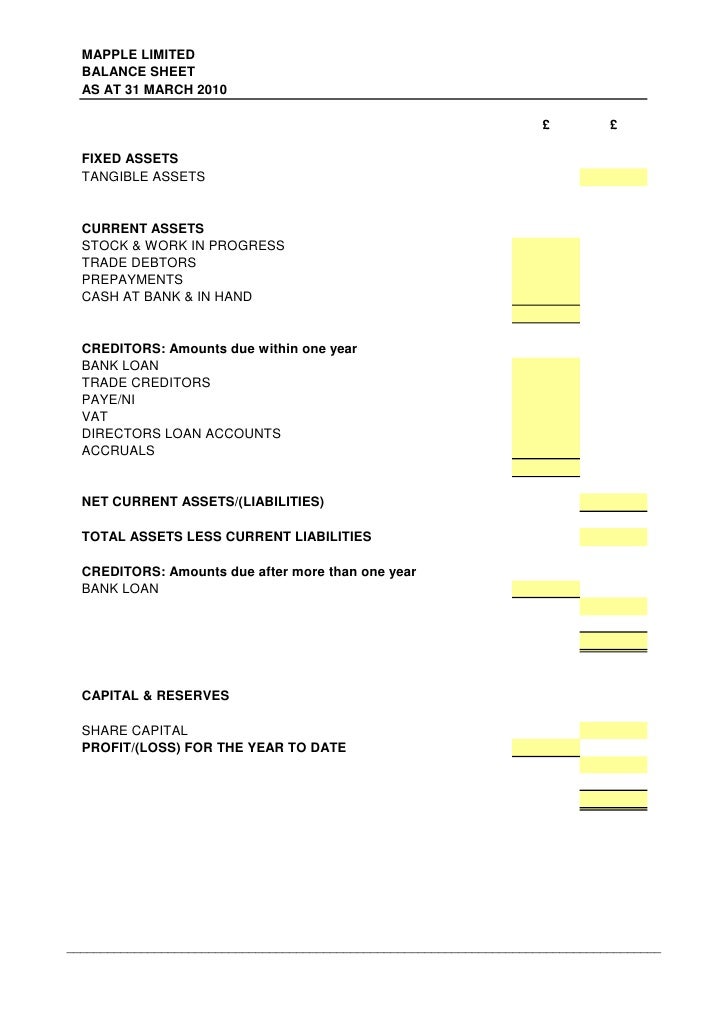

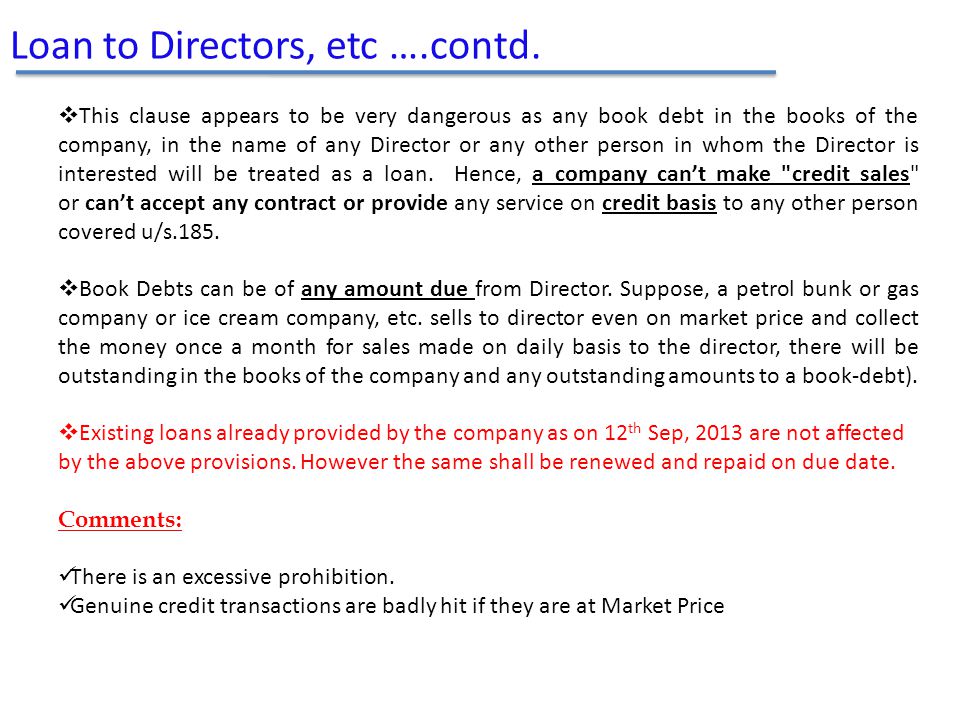

The company will not receive corporation tax relief on the amount of the loan written off. A due from account tracks assets owed to a company and is not used for the tracking. Amount due from director could be for a loan made by the company to the director so the director owes the company or perhaps for goods or services provided to the director from the company for which the director owes the company.

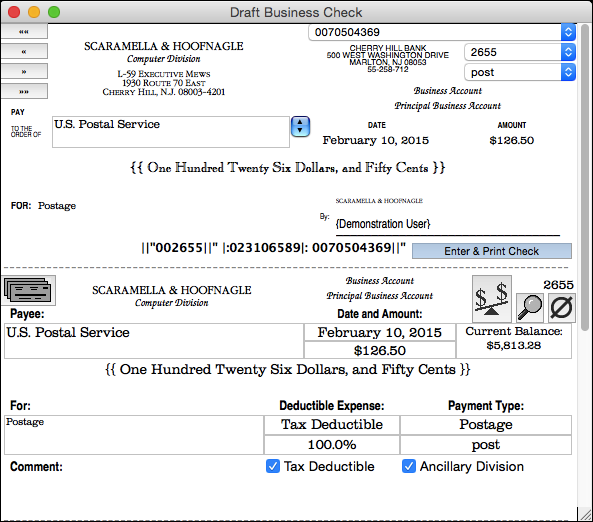

If the director pays the market rate of interest currently 4 due on the loan then there will be no benefit in kind. However the loan amount benefit in kind calculation and interest payments should still be shown on the form p11d. 30 november 2015 page 5 of 16 4 2 3.

For income tax purposes the amount is treated as dividend with the usual tax credit. Mixed funds if loans or advances to director are from internal funds and external funds the interest income is computed only on the portion related to amount of internal funds. Amount due could be for loans made from the director to the company or due to the director for services rendered.

The amount of loan written off will have to be included in the director s self assessment tax return on a specific box on the additional information pages. Amount of interest benefit 2012 200 000 5 38 8 967 2013 200 000 5 38 10 760 200 000x5 38 x10 12 example 2 mrs ong is a director of ocean pte ltd. In such circumstances the company must.

A due from account is a debit account that indicates the number of deposits currently held at another company. Select new bank deposit in the account field in the top left ensure you have selected the bank that the amount was received to and the corresponding date in the date field in the received from column within the add funds to this deposit section enter the name of the director in the account column. Loan or advances to director by a company public ruling no.

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)

/AppleBalanceSheetInvestopedia-45d2b2c13eb548ac8a4db8f6732b95a0.jpg)