Bonus Subject To Epf

Section 43 1 epf act 1991.

Bonus subject to epf. In this example the bonus is considered to be the employees income for 2019 because the employer s liability to pay the bonus arises in 2019 and employees become entitled to it in 2019. Wages for maternity leave. If you are wonder can a owner to contribute epf and his spouse then look no further on the contribution list.

Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the third schedule. Under section 45 of the employees provident fund act 1991 epf act employers are statutorily required to contribute to the employees provident fund commonly known as the epf a social security fund established under the epf act to provide retirement benefits to employees working in the private sector. Therefore the bonus will be taxed in ya 2020.

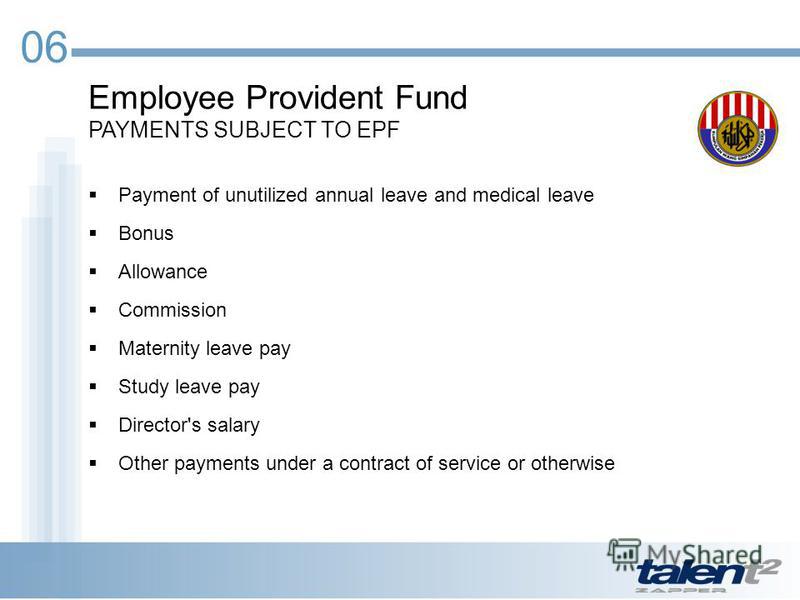

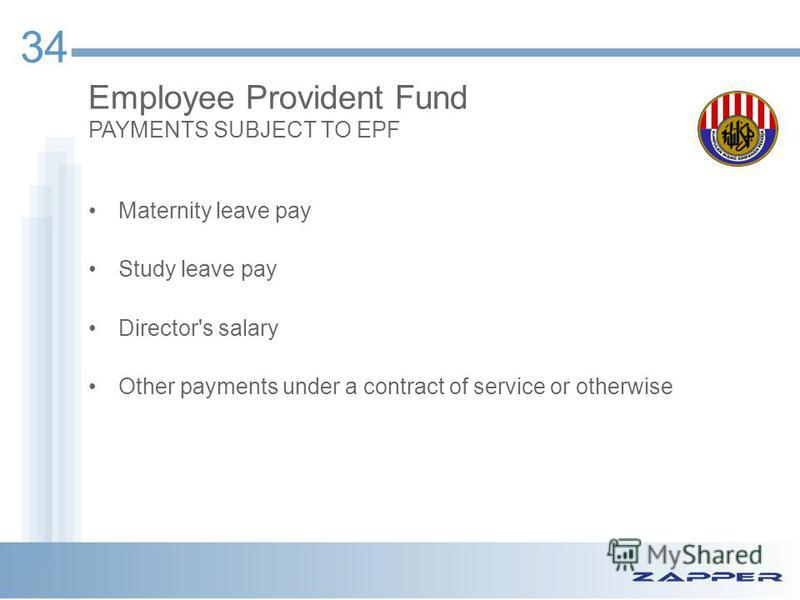

Payments for unutilised annual or medical leave. Among the payments that are exempted from epf contribution. Payments subject to epf contribution.

Bonus additional remuneration formula 2004. Epf members in the private and non pensionable public sectors contribute to their retirement savings through monthly salary deductions by their employers. Where a bonus additional remuneration is paid on or before 2008 to an employee in addition to normal monthly remuneration the amount of additional tax to be deducted in the month in which the relevant amount the additional payment is made shall be calculated based on bonus.

Other payments under services contract or otherwise. This bonus is not subject to conditions and cannot be rescinded without legal consequences. Which payments are subject to epf contribution and which are exempted.

In general all monetary payments that are meant to be wages are subject to epf contribution. Employers are legally required to contribute epf for all payments of wages paid to the employees. Wages not subject to epf contribution.

Mtd computation for additional remuneration year 2008 and before. Employees provident fund act 1991. These contributions comprising the member s and employer s share will be credited into the member s epf account.

Wages for study leave. Rate of contributions the current rates are 11 for the employee and 12 for the employer but employers are advised to keep abreast with changes which may take place from time to time. Service charge any money or payment either in the form of a.

Wages for half day leave.