Bonus Subject To Socso

The following wages or remuneration payable to staff workers are not subject to socso contribution.

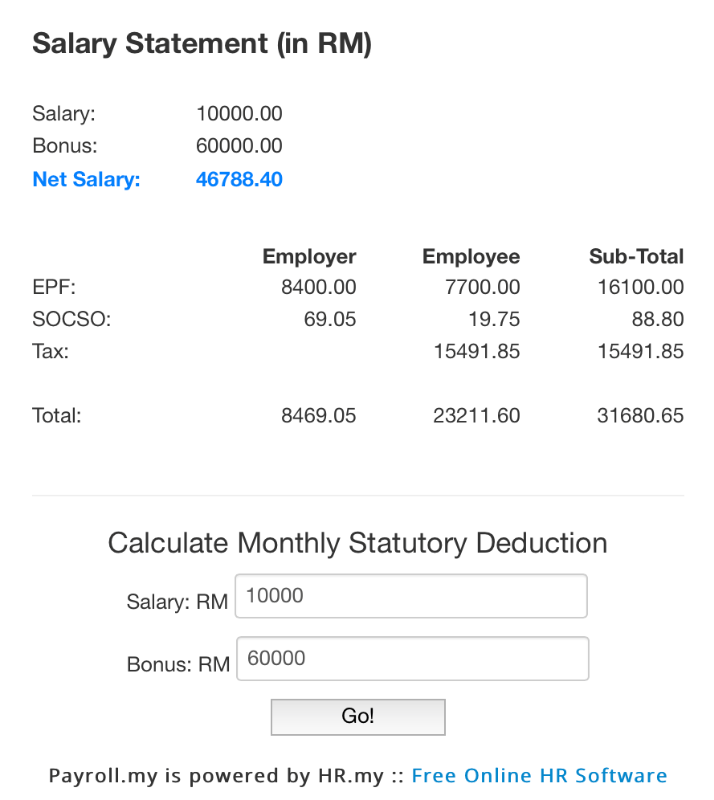

Bonus subject to socso. Jul 26 2018 history introduction in 2009 malaysia s income tax moved to a monthly tax deduction mtd or potongan jadual bercukai pcb. Employee contribution rate is based on the employee s wages overtime commissions service charge annual leave emoluments sick leave maternity leave public holidays incentives meal allowance cost of living and housing allowance and so forth. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the third schedule.

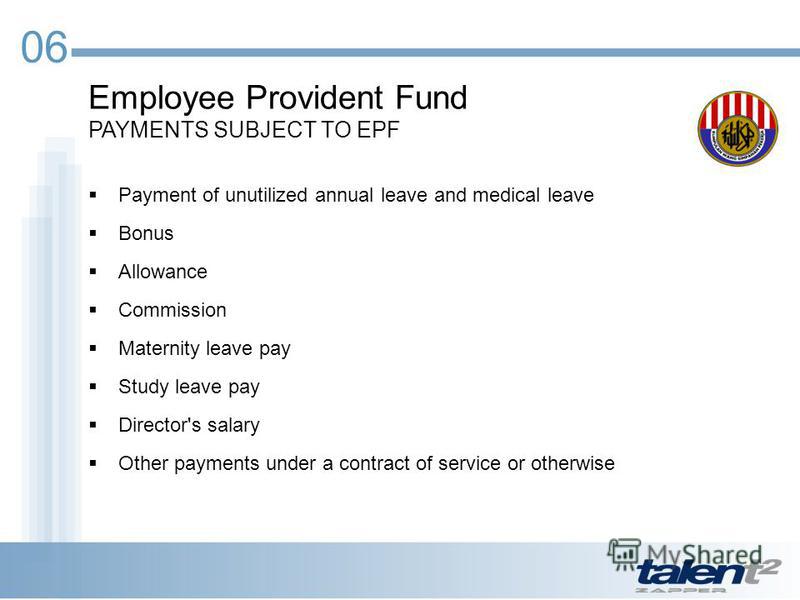

Malaysian payroll software and salary calculation. Section 43 1 epf act 1991. However the following payments are not considered as wages.

Wages subject to epf contribution. Which payments are subject to socso contribution and which are exempted. This was an increase of 58 percent over the same period in 2019 and almost three times higher than that in 2018.

All payments made to an employee paid at an hourly rate daily rate weekly rate piece or task rate is considered as wages. Payments by employer to any pension or provident fund for employees. Payments subject to socso contribution wages for contribution purposes refers to all remuneration payable in money by an employer to an employee.

Payments subject to socso contribution wages for contribution purposes refers to all remuneration payable in money by an employer to an employee. Received your bonus or commission but wondering about the large deductions that are incurred. Wages not subject to socso contribution.

All payments whether hourly daily weekly or monthly rated are. In general all payments which are meant to be wages are accountable in your monthly contribution amount calculation. Basic salaries overtime payments commissions payments in respect of leave service charges payments exempted from socso contribution the payments below are not considered wages and are.

Find out how to calculate your malaysian bonus tax calculations. Rate of contributions the current rates are 11 for the employee and 12 for the employer but employers are advised to keep abreast with changes which may take place from time to time. Socso reported that 4 917 malaysians had lost their jobs between march 1 and 29.

Gratuity payment s for dismissal or retrenchments. Wages not subject to socso contribution.