Uoa Reit Share Price

Uoa real estate investment trust.

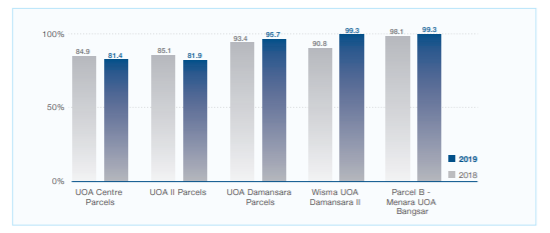

Uoa reit share price. One of o mighty s follower asked. Anyone buy this share omightycap posts. I wondered how uoa reit would fare amidst the increasing office supply in kuala lumpur with an additional 2 8 million square feet of commercial space from the exchange 106 at the tun razak.

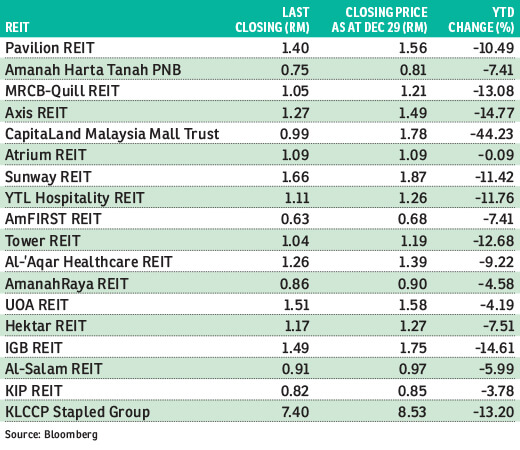

In terms of total shareholder performance it is one of the top 5 malaysian reits that made you money if you invested from their ipos. The trust invests in and owns commercial real estate and real estate related assets. Uoa real estate investment trust uoa reit was constituted on the 28 november 2005 and was listed on the main board of bursa malaysia securities berhad on the 30 december 2005.

4 weeks price range. Oct 2012 male mys. Overall the performance have been fairly good.

05 nov 2015 02 00 pm post 3. A united overseas australia uoa subsidiary has proposed to sell uoa corporate tower in kuala lumpur to uoa real estate investment trust uoa reit for rm700 million s 230 5 million in cash. Share avg volume 4 weeks 3 241.

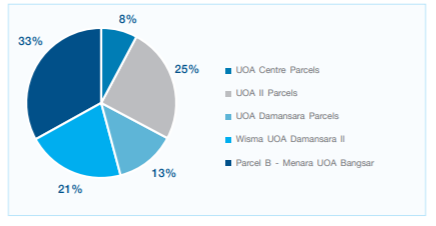

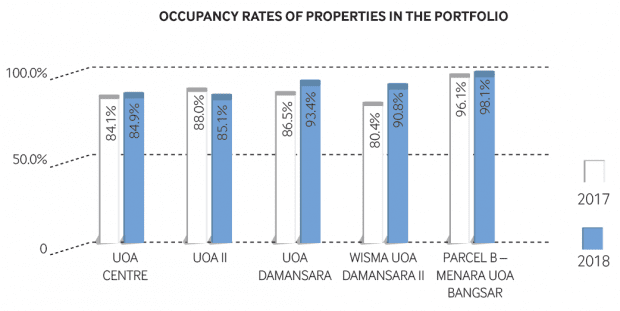

Oct 2012 male mys. Uoa reit currently owns five commercial properties in kuala lumpur. Stock analysis for uoa development bhd uoad bursa malays including stock price stock chart company news key statistics fundamentals and company profile.

02 nov 2012 06 58 pm post 2. Uoa reit s nla meanwhile would increase to 2 07 million square feet after factoring in the 732 871 sq ft in nla from the uoa corporate tower. So which of these is a best to invest.

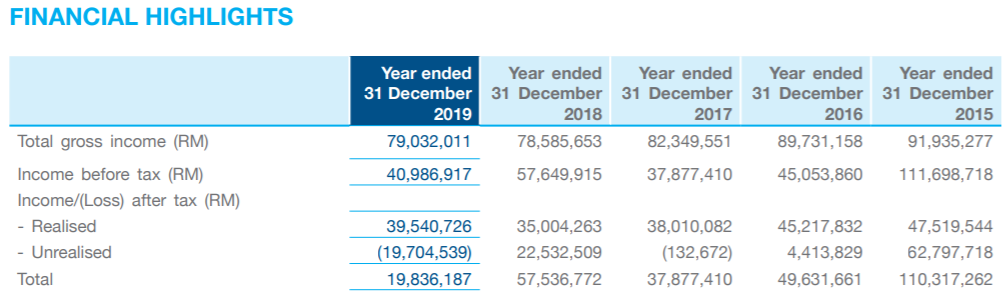

Share vwap rm 1 575. Pinnaclegrade first and final single tier dividend of 14 00 sen per ordinary share in uoa development bhd uoa development or the company share s. Reitpulse the dpu for uoa reit has been relatively stable and consistent.

02 nov 2012 06 47 pm post 1. Uoa development s share price was up two sen or 1 27 to rm1 59 as at 3 30pm valuing the group at rm3 38 billion. The proposed sale is thus deemed a related party transaction.

I4value uoa dev and uoa reit are part of uoa ltd. As share price is currently rm1 48 with possibility of further bottoming. Their debt exposure is well below the leverage limit of 50 c 26 3 as at 31 december 2019 and the reit has been relatively undervalued if we were to look at their price to book ratio at the current price.

1 year price range. Singapore and australia listed property group uoa is a majority unitholder in uoa reit. Share trade value rm 184 786.

Uoa real estate investment trust is a real estate investment trust. Sep 2015 male mys. The investment objective of uoa reit is to own and invest in real estate and real estate related assets used.