What Is Carriage Inwards And Carriage Outwards

Carriage refers to the cost of transporting goods into a business from a supplier as well as the cost of transporting goods from a business to its customers.

What is carriage inwards and carriage outwards. Difference between carriage inwards and carriage outwards. Carriage inwards vs carriage outwards. Carriage inwards is an expense incurred to bring the goods purchased to business premises or to a location as required by the business.

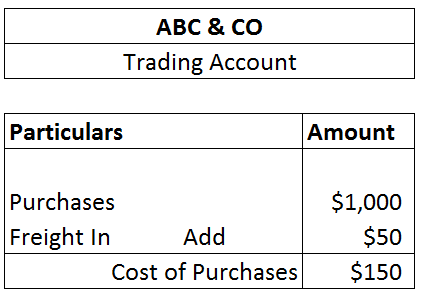

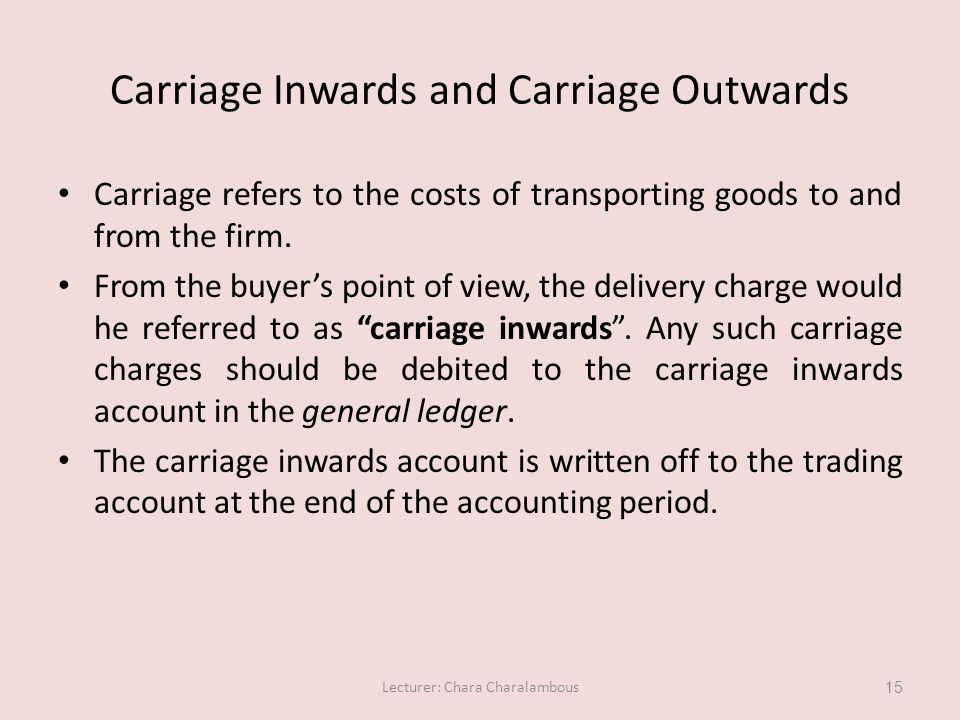

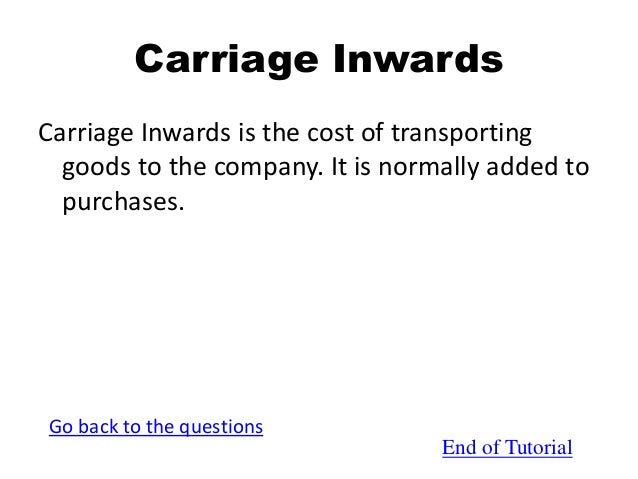

Carriage inwards and carriage outwards are two different types of expenses incurred by a company while buying and selling goods. Transportation cost of goods from one place to another place is called freight in or carriage inwards which is paid by the buyer in accounting it is a direct cost. Carriage inwards refers to the transportation costs required to be paid by the purchaser when it receives merchandise it ordered with terms fob shipping point carriage inwards is also known as freight in or transportation in.

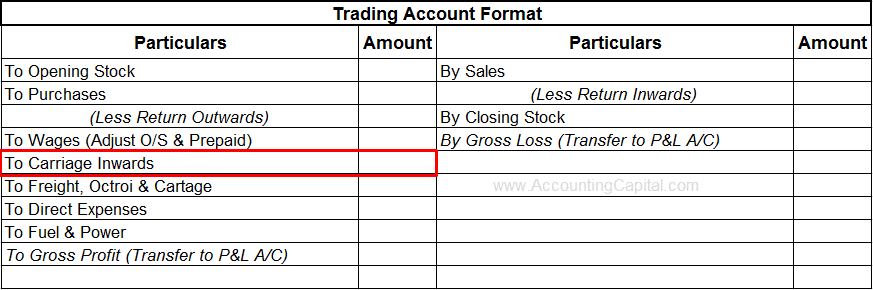

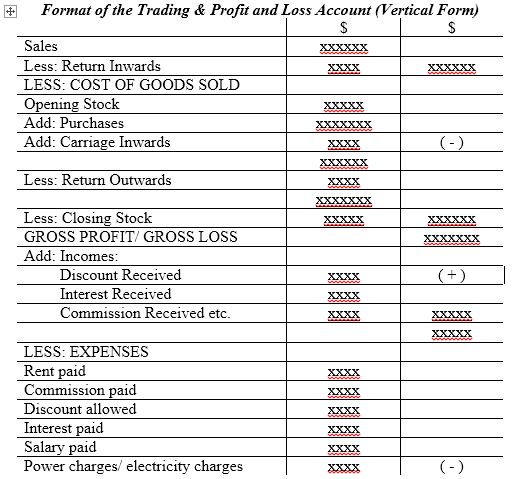

If goods purchased then it will be charged to goods in the trading account and if assets are purchased then i will be included in the cost of assets. The most appropriate accounting treatment of carriage inwards is to include it in the overhead cost pool that is allocated. Carriage costs are therefore included in purchase price.

This cost is referred to as carriage outwards. What is carriage inwards. This costs are debited to the carriage outwards account in the general ledger.

Carriage inwards is considered to be part of the cost of the items purchased. Many goods are bought with carriage paid. Carriage inwards and carriage outwards often referred to as freight in and freight out are terms given to the costs incurred by a business of transporting goods.

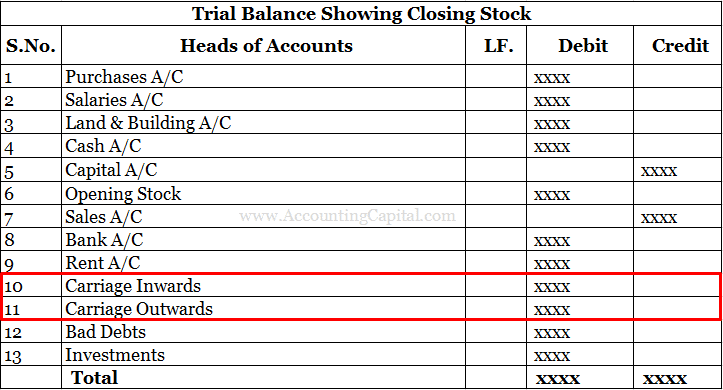

One is charged when the goods are being procured from the supplier whereas the other one. When the buyer sells the goods to his customer he incurs further delivery charges. They may be treated alike inside a trial balance however there is a clear difference between carriage inwards and carriage outwards.

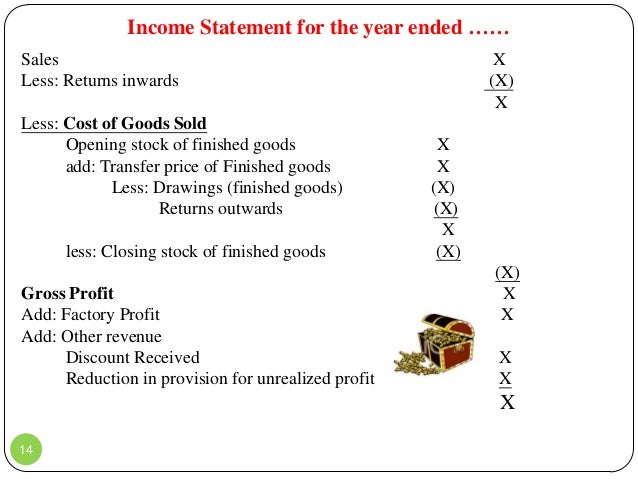

Carriage inwards is the shipping and handling costs incurred by a company that is receiving goods from suppliers. The cost of carriage outwards should be reported on the income statement as an operating expense in the same period as the revenue from the sale of the goods. Often the buyer is responsible for the cost of carriage inwards whereas the seller is responsible for carriage outwards.

Carriage costs are normally incurred in relation to the transportation of inventory but can in fact relate to other items such as supplies of stationary or non current assets such as plant and machinery. Just like carriage inwards there is also something called carriage outwards. Carriage outwards is not part of the cost of goods sold example of carriage outwards.

Carriage inwards definition and explanation. Carriage outwards is also known as freight out or freight on sales which is the transport costs your business is paying for shipping goods out to a customer. Carriage inwards and carriage outwards carriage can be seen as freight or transportation cost it is the carrying costs related to the purchase and sale of goods.

Definition of carriage inwards.