What Is Cukai Taksiran In English

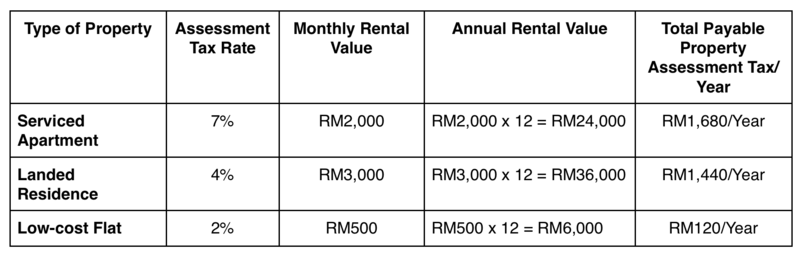

Jumlah cukai taksiran yang perlu dibayar adalah berdasarkan kadar peratus ke atas nilai tahunan.

What is cukai taksiran in english. Ia adalah cukai yang dikenakan ke atas harta tanah yang terletak didalam kawasan mpsj. Nilai tahunan x kadar cukai. Show posts by this member only post 2.

Human translations with examples. Assessment rates cukai pintu or cukai taksiran will still be imposed although the property building or house is empty not occupied. Back in feudal times all land belonged to the monarch king sultan or whoever was at the throne of those lands.

2 kadar peratusan ditetapkan oleh kerajaan negeri selangor dan rayuan tidak boleh dibuat terhadapnya. Mar 25 2011 09 43 am.

Contextual translation of bil cukai taksiran cukai pintu into english. Penggal kedua 1 julai hingga 31 ogos. Contoh kiraan cukai taksiran.

What is the difference between cukai taksiran vs cukai tanah. Contextual translation of cukai taksiran into english.

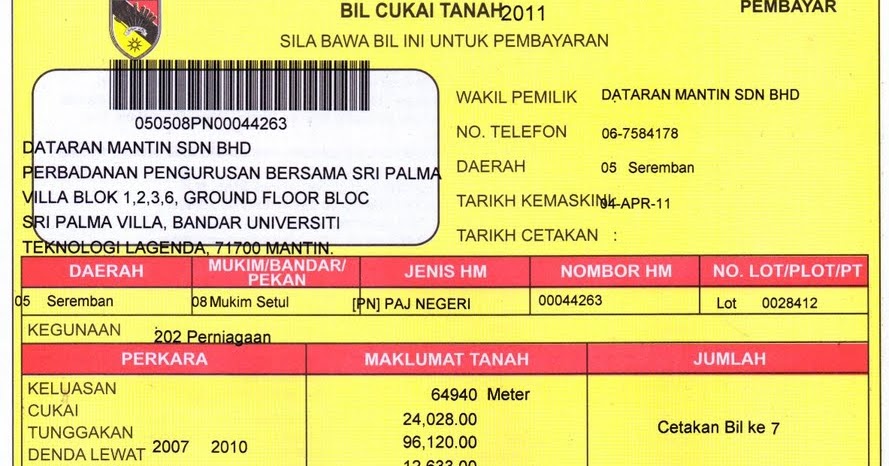

1 nilai tahunan ditetapkan oleh jabatan penilaian dan pengurusan harta mbpj. Sekiranya cukai taksiran tidak dijelaskan dalam tempoh yang ditetapkan anda boleh dikenakan tindakan tindakan tersebut notis denda borang. Cukai tanah literally translates to land tax which is a tax levied on the land that s in use upon whoever is using it.

Cukai taksiran vs cukai tanah. However the owner can apply for remission claims over the period of vacancy by giving written notice to the local or municipal authorities within seven 7 days from the date the building was vacated. Cukai taksiran perlu dibayar dua kali setahun iaitu pada penggal pertama 1 januari hingga 28 februari.

Cukai taksiran atau cukai pintu dikuatkuasakan mengikut peruntukan seksyen 17 akta kerajaan tempatan 1976 akta 171. Dunno what is cukai tanah n cukai pintu called in english. How much is the cukai tanah n cukai pintu for a lease hold property.

Human translations with examples. Mar 4 2018 10 34 pm updated 3y ago. According to the dbkl s website assessment fee or cukai taksiran cukai pintu is the tax imposed by dbkl on private property such as homes business property industrial and vacant land located within the federal territory of kuala lumpur for.