What Is Ea Form

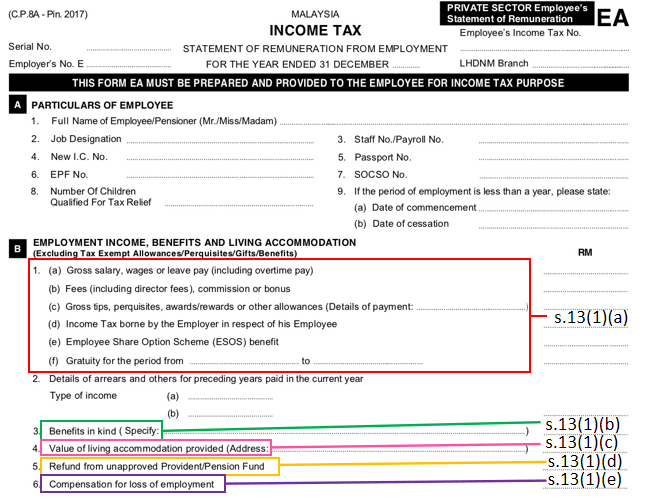

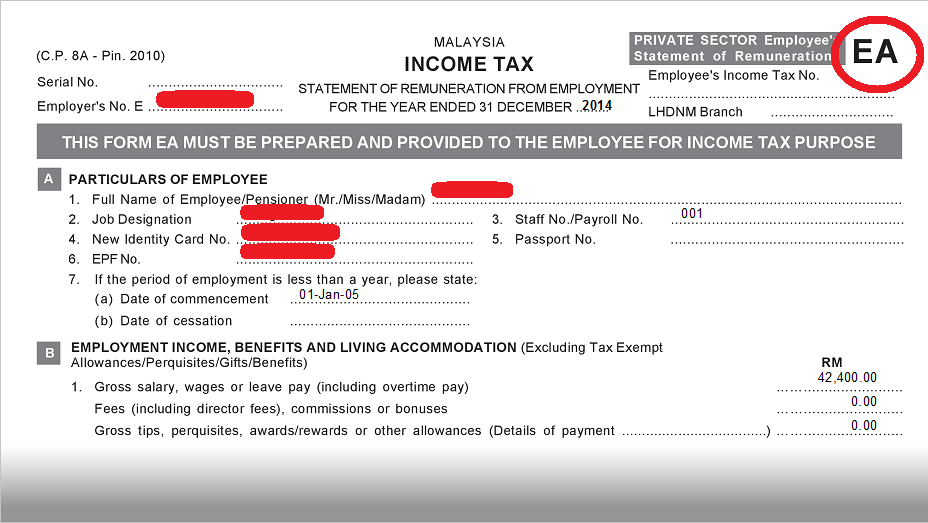

Ea form is used for the filing of personal taxes during tax season.

What is ea form. Ea play is the ultimate game destination for anyone who loves ea titles. You will usually use this form to file personal taxes during tax season. Each is one option get in to view more the web s largest and most authoritative acronyms and abbreviations resource.

The world week 3. Get more from the games you love with ea play a game membership that gives you exclusive challenges and in game rewards member only content and more. Ea form is a yearly remuneration statement for private employees that includes your salary for the past year.

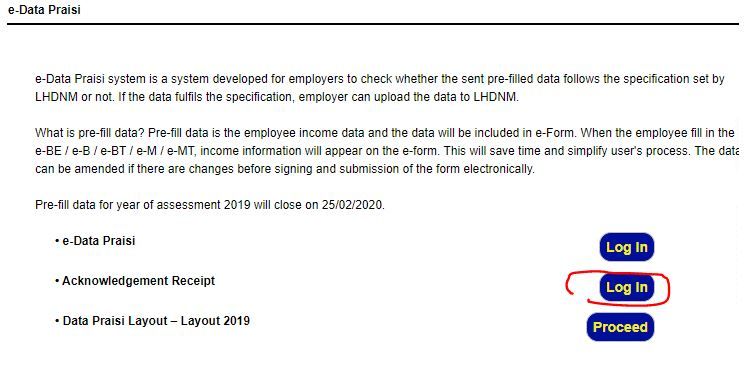

For those involved you know that this is not always the case. Most people think that preparing the form ea annual income statement and form e together with the cp 8d return of remuneration by an employer is just a click of a button in the payroll system. There is an option that allows you to share the exported ea form with you employees easily if you don t want your employees to have access to the exported ea forms just remember to uncheck it.

Membership gives you more of your favorite electronic arts games more rewards more exclusive trials and more discounts. To export employee ea form you may go to payroll annual salary statement then click at the export ea form button. Yearly remuneration statement ea ec form refer to section 83 1a income tax act 1967 with effect from year of assessment 2009 every employer shall for each year prepare and render to his employee statement of remuneration of that employee on or before the last day of february in the year immediately following the first mentioned year.

Looking for the definition of ea. Read more read more madden nfl 21 derwin james vs. Every employer shall for each year prepare and render to his employee a statement of remuneration of that employee c p 8a ea and c p 8c ec form on or before the last day of february in the year immediately following the first mentioned year in order for each employee to fill and submit return form in accordance to subsection 83 1a income tax act 1967 act.