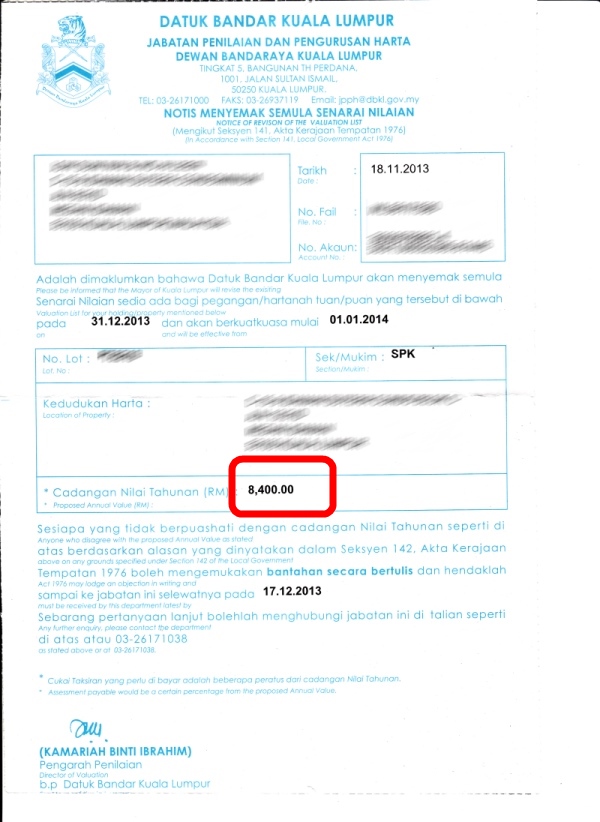

What Is Quit Rent And Assessment

Quit rent quit rent or quitrent is a tax or land tax imposed on occupants of freehold or leased land in lieu of services to a higher landowning authority usually a government or its assigns.

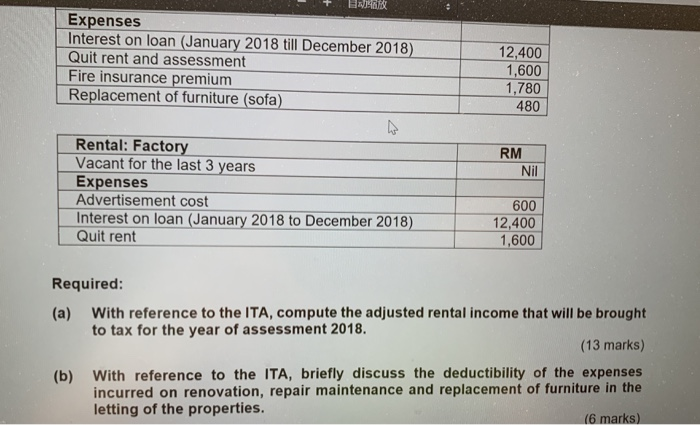

What is quit rent and assessment. It is a form of land tax collected by state governments and is imposed on owners of freehold or leased land. Quit rent is a land tax payable to the state authority while assessment rate is collected to finance the construction maintenance of public infrastructure. A local property tax which applies to all properties and is calculated on an annual rate of one to two sen per square foot.

Land and property owners must known state due dates and assessment rates and act of their own volition in paying the tax. Those who pay either tax after the due date must pay a fine. Assessment rates or cukai pintu is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services.

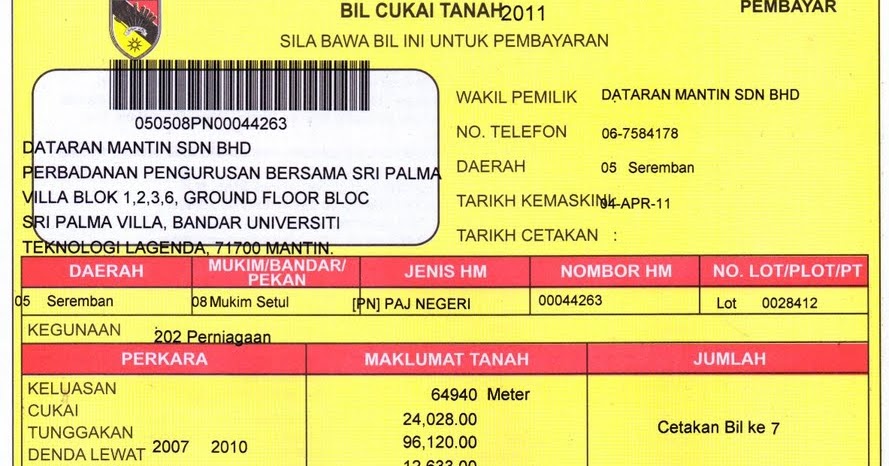

Redditus quieti freed the tenant of a holding from the obligation to perform such other services as were obligatory under feudal. In the case of parcel rent and quit rent those small variations would refer to one main thing. Quit rent or cukai tanah is a form of land tax collected by your state government for property in malaysia.

Quit rent cukai tanah besides the assessment tax the other main cost associated with property and land ownership in malaysia is quit rent or cukai tanah. To put it simply parcel rent is actually a type of quit rent that is specifically meant for strata properties which are governed by the strata management act sma 2013 and the strata titles act sta 1985. It must be paid by the landlord to the state authority via the land office and is payable in full amount from 1 st january each year and will be in arrears from 1 st june each year.

Quit rent liability is generally less than rm 100 00 annually. The bill is yellow in colour. Quit rent and assessment tax is due by a certain date each year without demand from the government.